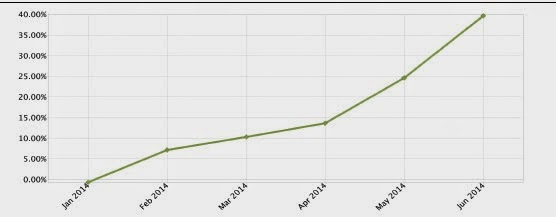

First quarter was good, but I really picked it up 2nd Quarter, putting on 26.6%:

Which easily has surpassed the major averages

What went right?

Hclp: This was a fantastic move. I stayed in despite an early test and was richly rewarded.

NOK, although the biggest part of the move occurred last year, NOK continues to impress. NOK is actually more impressive than the chart suggests because it paid a .51 special dividend in June.

The next drivers of my return has been a dozen or so trades that have put on 2-5 - 5% R, type returns. I won't go through all of them but here's a few that I think have more upside.

RBCN:I caught this twice now. Most recently at 7.52 still riding half the position.

VRNS: This is a relatively new trade, which I put on in late June. Already 20% gain, but I think it wants more:

RFMD: This had an test in early April, but rallied strong and I see no reason to sell yet.

Shorts. Although I've primarily played the long side of the market, I've had some decent gains on the few shorts I've played.

YOD: Is a fundamentally flawed stock which I've shorted over 5 and then repeatedly on the way down. I've kept selling the spikes.

GNRC got my quarter off to a great start when it missed on the top line. I did well but covered too early, had I held I would have had monstrous gains

Looking at my wins is fun (at least for me). But the biggest reason for my 40% YTD return is that I have kept my losses minimal. 8 losing trades against 24 wins. But most importantly most of my losses were less than 1R.

No comments:

Post a Comment